Table Of Content

Actual cash value (ACV) refers to a policy that covers items for their value at the time they are lost or stolen. This means depreciation will be deducted from the replacement cost value of the items. Replacement cost refers to the cost to replace an item, regardless of how old or outdated it may be. To learn more about personalized home insurance quotes, call us or use our online application to start saving on five-star coverage today. Yes, to some degree – and that’s a good thing considering 6,500 Floridians file sinkhole-related insurance claims each year. What’s more, if your home is in a Special Flood Hazard Area (SFHA) like many Florida homes, your lender may require you to have flood insurance, too.

High Risk of Storm Losses

Tallahassee has the least expensive neighborhoods for home insurance costs. Insurance.com analyzed home insurance rates from major insurance companies in nearly every ZIP code in Florida. Although standard homeowners insurance policies usually cover wind damage, yours might exclude it if you live on or near the Florida coast.

Premium Discounts for Hurricane Loss Mitigation

We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. Our editorial team does not receive direct compensation from our advertisers.

Why is my Florida homeowners insurance being canceled?

4 Best Homeowners Insurance Companies in Tampa (2024) - MarketWatch

4 Best Homeowners Insurance Companies in Tampa ( .

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

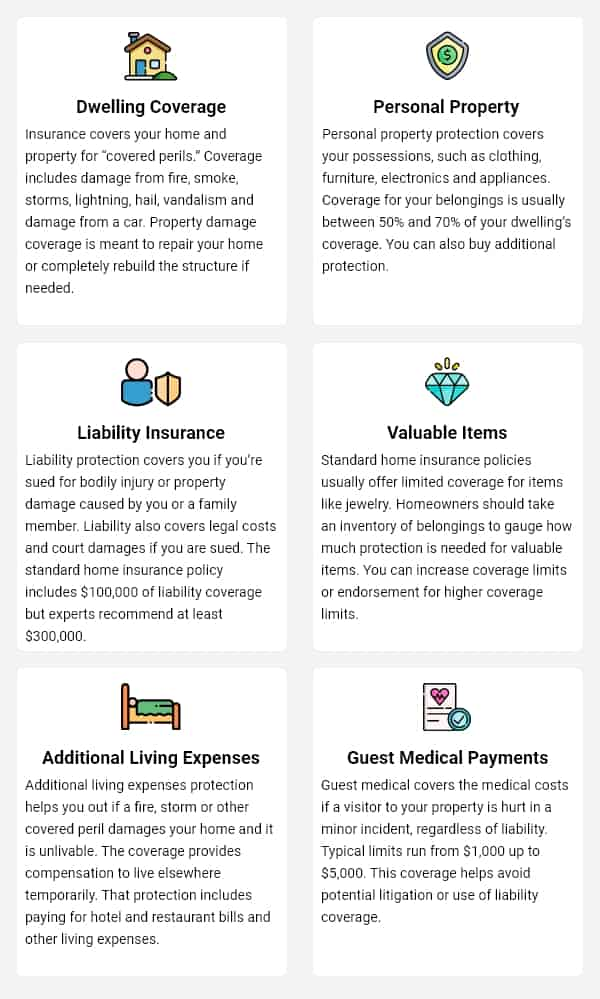

It also includes printable pages to start your home inventory and document vital insurance information. When a covered disaster damages your home and personal property, your homeowners insurance may help pay to repair or rebuild your home and replace damaged or stolen personal property. Many home insurance companies have stopped selling or gone insolvent in Florida, which has pushed more and more homeowners to get coverage through Citizens. It’s also important to note that Florida is one of a handful of states that requires a separate hurricane deductible. The deductible only applies if your home sustains hurricane damage from a named storm.

Please note that these rates may not include any coverage for hurricane damage. Citizens Property Insurance, the state’s insurer of last resort, is also a major provider. By law, homeowners insurers in Florida must offer coverage for “catastrophic ground cover collapse,” a specific type of sinkhole damage. One way to bring down your home insurance cost in Florida is to lower your risk of hurricane damage. The Florida legislature recently approved more funding for the “My Safe Florida Home” program, which provides grants to help homeowners strengthen their homes against hurricanes.

Plus, while many competitors don't have the financial strength to pay out claims after several natural disasters in the same year, State Farm isn't one of them. Best for financial strength and stability — only six insurance companies out of nearly 70 we reviewed hold this title. And it doesn't skimp on coverage, offering flood, wildfire, and earthquake protection — one of few competitors that offers all three insurance policies to homeowners in many high-risk states. There is also hope that Citizen's higher premiums will encourage private insurers to offer competitive prices slightly below what Citizens offers. This will move more of the burden of high-risk policies back into the public sector.

Here's the cheapest home insurance companies in Florida for a homeowner with three claims within a five-year period. Older and historic homes are usually more expensive to insure than newer homes. All rates based on the above coverage limits except where otherwise noted. Our picks for the best homeowners insurance companies in Florida reflect the best options for the here and now, so carriers with limited or no policy options were not considered in this guide.

Reforms improving insurance market? Homeowners say 'show me' - South Florida Sun Sentinel

Reforms improving insurance market? Homeowners say 'show me'.

Posted: Fri, 26 Apr 2024 01:30:00 GMT [source]

Although Johnson says that damage from hurricanes is a primary reason for the state’s high rates, he thinks several factors are at play. “Insurance fraud, severe weather events, and a very litigious environment in the state contribute significantly to the higher potential for losses among insurance providers,” Johnson says. Insurance policies differ between insurance companies so you must review your own contract. Also, there are limitations on certain types of personal property, such as antiques, firearms, jewelry, furs and electronics, including computers and their equipment. Founded in 2000, Stillwater Insurance Group offers homeowners, renters, and condo insurance in all 50 states.

Best homeowners insurance in Florida of April 2024

Before you start shopping, make sure you’ve reviewed our list of the best and cheapest home insurance companies in Florida to help you find the best deal. It's closely followed by Leon and Bradford counties, with rates of $2,950 and $2,966, respectively. State Farm is the best home insurance company in Florida thanks to low rates and a low complaint ratio with the National Association of Insurance Commissioners (NAIC). Travelers, Nationwide, Allstate, and Progressive are among the top car insurance companies in Florida. Homeowners insurance in Florida costs an average of $4,218 a year, well above the national average. State Farm and Travelers are among the best home insurance companies in Florida.

That home insurance estimate is for a policy with $350,000 in dwelling coverage, $175,000 for personal property coverage and $100,000 in liability coverage. Travelers has the cheapest home insurance policies in Florida, with average annual premiums of $2,002 for a $300,000 dwelling coverage policy. With average rates climbing as high as $27,986 for the same dwelling coverage policy through Florida Farm Bureau Insurance, Travelers offers substantially lower rates for qualifying homeowners. Purchasing sufficient coverage for your home and your personal property is an important decision.

Citizens is Florida’s “Fair Access to Insurance Requirements” (FAIR) plan carrier, which means it’s a state-backed insurance company of last resort. All new Citizens policyholders will also be required to carry a flood insurance policy, although the rollout may take place at different times for existing policyholders. The carrier does offer a few useful endorsements, including sinkhole coverage and replacement cost on personal property. Securing cheap homeowners insurance in Florida may not be an option for many homeowners.

Tallahassee has the cheapest homeowners insurance among the state's largest cities, with an average rate of $2,650 per year, which is $220 per month. Below, we’ve gathered everything you need to know to get the best homeowners insurance in Florida. We’ll break down Florida homeowners insurance rates by county and ZIP code and show you how to get the cheapest home insurance in Florida without compromising coverage or service.

No comments:

Post a Comment